The Bihar Chamber of Commerce and Industries asked the Nitish Kumar government to review non-residential taxes.

Photo Credit: The Suncity News.

Patna, June 26, 2024: The Bihar Chamber of Commerce and Industries has urged the state government to reconsider the steep increase in non-residential property taxes.

In a letter addressed to Chief Minister Nitish Kumar and Urban Development and Housing Minister Nitin Naveen, the Chamber requested that industries, trades and businessmen not be burdened with additional financial load.

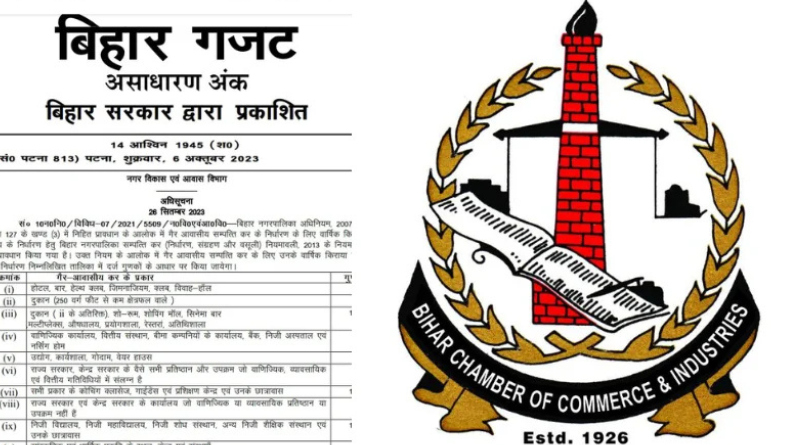

The Chamber pointed out that non-residential property taxes were revised sharply, in some cases up to three times, through a Gazette notification issued on October 6, 2023.

The Chamber believes a tax hike could hurt businesses:

The business body said it has already written letters on the issue in November and December 2023, and again in February this year, but no corrective steps have been taken.

Subhash Patwari, the chairman of the Bihar Chamber of Commerce and Industries, said the sudden and sharp increase is impractical and is hurting small entrepreneurs who already pay multiple taxes, including GST, professional tax, income tax, EPFO, ESIC and pollution-related charges.

He warned that a high tax burden may discourage business activity and ultimately affect the state’s own revenue collection.

Patwari said that if the increase is unavoidable, it should not exceed 10%.

According to the revised slabs, the state government has identified 11 categories of commercial establishments under the new regime.

Three-fold tax hike in some categories:

Hotels, bars, health clubs, gyms, clubs and marriage halls now pay a threefold annual tax.

Shops above 250 sq. ft, showrooms, malls, cinema halls, multiplexes, hospitals, labs, restaurants and guest houses pay 1.5 times the earlier tax.

Commercial offices, banks, insurance companies, financial institutions, private hospitals, and nursing homes pay double the earlier tax. Industrial units, warehouses, and workshops pay two-fold tax as well.

Also Read: GST fraud surfaced in Muzaffarpur.

EOM.

Pingback: Bihar Chamber of Commerce, ESIC hold seminar on SPREE-2025 to promote employer, employee registration.

Pingback: India can develop only through the growth of lower strata, says Dr Rajiv Kumar.